bitcoin-life.site

Overview

Appraisal Came In Low Refinance

A low appraisal means that the lender does not want to make the loan at the agreed-upon sales price. The lender makes a loan based on the loan-to-value ratio. What all that means for you as a buyer is: if you plan to finance your home through a lender and your appraisal comes in low, you're on the hook for the. → If the appraisal comes in lower than the purchase price, you're on shakier ground. Your lender could charge you higher interest rates, or it may not even. My Appraisal Came in Low — Now What? · If you find errors, request a new appraisal. Thoroughly review the appraisal report to see if key information may be. Even if you have a great credit score, if a lender thinks you don't have a lot of equity in the property, they may deny the refinance. A home with a low. When refinancing, the only appraisal problem you should worry about is having a low appraisal value. You might be unable to get the type of refinance loan that. If your appraisal value puts your home equity at less than 20%, then you'll get stuck paying for private mortgage insurance (PMI) or having to bring some cash. For refinance home loans the LTV is determined by dividing the loan amount by the appraised value. The higher the appraised value, the lower the LTV. The. A low appraisal means that the lender does not want to make the loan at the agreed-upon sales price. The lender makes a loan based on the loan-to-value ratio. A low appraisal means that the lender does not want to make the loan at the agreed-upon sales price. The lender makes a loan based on the loan-to-value ratio. What all that means for you as a buyer is: if you plan to finance your home through a lender and your appraisal comes in low, you're on the hook for the. → If the appraisal comes in lower than the purchase price, you're on shakier ground. Your lender could charge you higher interest rates, or it may not even. My Appraisal Came in Low — Now What? · If you find errors, request a new appraisal. Thoroughly review the appraisal report to see if key information may be. Even if you have a great credit score, if a lender thinks you don't have a lot of equity in the property, they may deny the refinance. A home with a low. When refinancing, the only appraisal problem you should worry about is having a low appraisal value. You might be unable to get the type of refinance loan that. If your appraisal value puts your home equity at less than 20%, then you'll get stuck paying for private mortgage insurance (PMI) or having to bring some cash. For refinance home loans the LTV is determined by dividing the loan amount by the appraised value. The higher the appraised value, the lower the LTV. The. A low appraisal means that the lender does not want to make the loan at the agreed-upon sales price. The lender makes a loan based on the loan-to-value ratio.

While it's always great for the property appraisal to come back higher than the amount you agreed to buy it for, this is no way affects the loan amount you. You also may run into issues if you're refinancing a mortgage and wind up with a low appraisal. To be approved for a loan when refinancing, your home needs. They came in handy on a few occasions where the property was renovated (representing the top of the market in value) and a few years later when the property. Now the appraisal has come back, and it is below value. Don't freak out (yet), Call you lender and ask them if they have a Reconsideration of Value form and. When/if the opportunity to refinance into a lower rate happens, great - than seize the opportunity! In the meantime, plan your life and. And after the equity of the property increases, you can agree on a balloon payment or cash-out refinance. You can also ask the lender to order a second. For those looking to refinance, a higher appraisal might nudge your interest rate in a more favorable direction, thanks to something called a 'loan level. To settle the issue, your refinancing lender will require an appraisal. The appraisal process doesn't take long, but it does require an appraiser coming to your. The lender cannot control whether or not an appraiser can adequately appraise the house; but the lender does control the fee paid for such an appraisal. The. If you don't have an appraisal contingency, you've waived your right to counter-offer if the appraisal comes in low. So in essence whatever the appraisal comes. A low appraisal is when that value is lower than a seller's asking price or the offer a buyer and seller have agreed upon. This can raise a problem. Lenders. Renegotiating the price: If the appraisal comes back low, but close to the listing price, you can simply lower or re-negotiate the price with the buyer so it's. Sometimes called an "appraisal gap", a low appraised value can mean a canceled sales contract. Lenders may not be able to approve a mortgage loan if the. If you (along with the realtor or homeowner in the case of a refinance) believe that the appraisal is inaccurate, you can file an appeal on the decision with. Borrowers who find the appraised value of the home is lower than the asking price will either need to make up the difference in case, renegotiate with the. If you're refinancing a conventional mortgage, a low appraisal can prevent you from doing so. The home needs to appraise at or above the amount you want to. When a home appraisal comes in low, this creates problems for both the buyer and the seller. Fortunately, you're not out of alternatives. Options for Moving Forward with Selling Your Home · Ask your buyer to make up the difference in cash. · Lower your asking price to match the appraised value. Appraisals fees can cost around $, which can be an expensive price to pay up front. If you are refinancing to save money through lower monthly payments or.

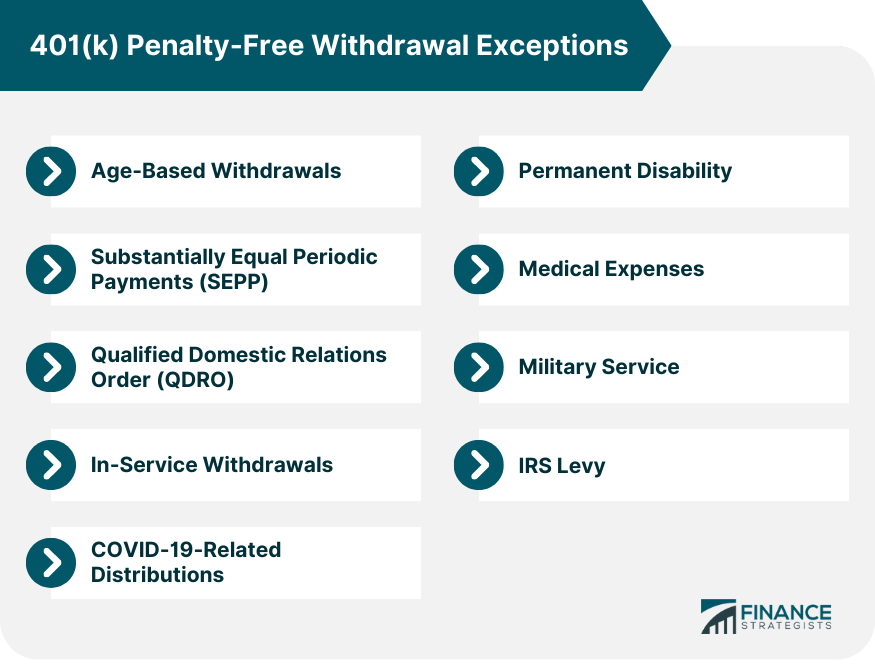

Tax Penalty For 401k Withdrawal

Early Withdrawals from Qualified Retirement Plans May Result in Tax Penalties. There Are Some Exceptions to the 10% Penalty - Find Out Here. Withdrawing taxable funds from a tax-deferred retirement account before age 59½ generally triggers a 10% federal income tax penalty, on top of any federal. Once you start withdrawing from your traditional (k), your withdrawals are usually taxed as ordinary taxable income. Early withdrawals will be considered taxable income. That means you must report the amount you withdraw as 'income' when you file taxes in the year you withdraw. Yes—your (k) withdrawal is subject to federal income tax. (The income withdrawal penalty and income tax as normal. When are (k) withdrawals. 2) Withdrawal Penalty. A Canadian RRSP does not have early withdrawal penalties, aside from withholding tax and income tax; whereas, a (k) has a You usually put money into a tax-deferred savings plan to save for your future retirement. If you withdraw money from your plan before age 59 1/2, you might. Taking distributions before reaching age 59½ may subject one to a 10% tax penalty, in addition to income taxes, unless one meets one of the exceptions to the. In many cases, you'll have to pay federal and state taxes on your early withdrawal, plus a possible 10% tax penalty. Early Withdrawals from Qualified Retirement Plans May Result in Tax Penalties. There Are Some Exceptions to the 10% Penalty - Find Out Here. Withdrawing taxable funds from a tax-deferred retirement account before age 59½ generally triggers a 10% federal income tax penalty, on top of any federal. Once you start withdrawing from your traditional (k), your withdrawals are usually taxed as ordinary taxable income. Early withdrawals will be considered taxable income. That means you must report the amount you withdraw as 'income' when you file taxes in the year you withdraw. Yes—your (k) withdrawal is subject to federal income tax. (The income withdrawal penalty and income tax as normal. When are (k) withdrawals. 2) Withdrawal Penalty. A Canadian RRSP does not have early withdrawal penalties, aside from withholding tax and income tax; whereas, a (k) has a You usually put money into a tax-deferred savings plan to save for your future retirement. If you withdraw money from your plan before age 59 1/2, you might. Taking distributions before reaching age 59½ may subject one to a 10% tax penalty, in addition to income taxes, unless one meets one of the exceptions to the. In many cases, you'll have to pay federal and state taxes on your early withdrawal, plus a possible 10% tax penalty.

Learn how you may avoid the 10% early withdrawal penalty when taking money from your retirement account. While you can access your (k) funds penalty-free after reaching age 59½, withdrawing earlier is subject to the 10% penalty on top of regular income taxes. The US will levy a 30% penalty tax if i withdraw the K into my US bank account, then I have the expense of the exchange to GBP. Does the UK-US Tax Treaty. With a typical early withdrawal, providers must withhold 20% for Federal tax at time of distribution. You may avoid taxation altogether by repaying these. If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates. · There are. Unless you qualify for an exemption, you will also owe a 10% early withdrawal penalty tax on the full amount when you file your taxes. withdraw from your When you take a hardship withdrawal, income taxes and a 10% tax penalty are assessed. Note that your employer has the option of requiring your spouse's. Unfortunately, there's usually a 10% penalty—on top of the taxes you owe—when you withdraw money early. This is where the rule of 55 comes in. If you turn 55 . The IRS also prohibits you from withdrawing more than you need to cover the hardship plus local, state and federal income taxes or penalties. Some types of. The IRS assesses a 10% early withdrawal penalty in addition to the income tax that you incur on the withdrawal. For example, if you withdraw $20,, you will. Withdrawals taken from your (k) account if you are age 59½ or older will not have a penalty. However, a 20% tax on your withdrawal will be withheld if the. Taking distributions before reaching age 59½ may subject one to a 10% tax penalty, in addition to income taxes, unless one meets one of the exceptions to the. Thinking of tapping into your retirement savings early? · A $2, 10% early withdrawal penalty · $5, in federal income taxes. Yes—your (k) withdrawal is subject to federal income tax. (The income withdrawal penalty and income tax as normal. When are (k) withdrawals. When you make an early withdrawal from your k, you will have to pay a steep penalty of 10 percent of the withdrawal to the IRS. As with an early withdrawal, you may be subject to federal and state income taxes, as well as an additional 10% federal income tax if you are under age 59½. Anyone who withdraws from their (K) before they reach the age of 59 1/2, they will have to pay a 10% penalty along with their regular income tax. Penalty tax: You could owe additional taxes for early withdrawals, generally before age 59 ½. Withholding: Your (k) may be required to withhold 20% of the. If you took a distribution from your (k) or another qualified retirement plan (excluding IRAs) before you turned 59 1/2, you'll pay a 10% early withdrawal. On top of the 10% penalty, you'll owe taxes on the amount you withdraw from your (k). Your plan administrator is required to withhold 20% of your withdrawal.

Can You Own More Than One Roth Ira

Yes. You can have multiple accounts, but there is an overall limit to how much you can contribute each year. In most cases, there is no limit on. If you are married and file a joint tax return, each spouse can make a contribution up to the current limit; however, your combined contributions can't be more. You can contribute to different types of IRAs. Contributing to a Roth IRA and a traditional IRA is absolutely allowed as long as you're eligible. But remember, the IRS contribution limits are cumulative for all Traditional and Roth IRAs owned by an individual. Can employers match employee contributions? When does a Roth conversion make sense? You may want to discuss Roth conversions with your financial advisor and tax advisor if one or more of the following. You can contribute at any age as long as you have a qualifying earned income. Earnings grow tax-free. Contributions and potential investment gains accumulate. While it is possible to have multiple Roth IRAs, there are still limits as to much how you can contribute on an annual basis. IRA insight: Consider a Roth IRA if you expect to be in a higher tax bracket during retirement. And remember that you can contribute to both a traditional and. The IRS does not impose a restriction on the number of IRAs an individual can own, which you are free to open multiple IRAs to suit your retirement savings. Yes. You can have multiple accounts, but there is an overall limit to how much you can contribute each year. In most cases, there is no limit on. If you are married and file a joint tax return, each spouse can make a contribution up to the current limit; however, your combined contributions can't be more. You can contribute to different types of IRAs. Contributing to a Roth IRA and a traditional IRA is absolutely allowed as long as you're eligible. But remember, the IRS contribution limits are cumulative for all Traditional and Roth IRAs owned by an individual. Can employers match employee contributions? When does a Roth conversion make sense? You may want to discuss Roth conversions with your financial advisor and tax advisor if one or more of the following. You can contribute at any age as long as you have a qualifying earned income. Earnings grow tax-free. Contributions and potential investment gains accumulate. While it is possible to have multiple Roth IRAs, there are still limits as to much how you can contribute on an annual basis. IRA insight: Consider a Roth IRA if you expect to be in a higher tax bracket during retirement. And remember that you can contribute to both a traditional and. The IRS does not impose a restriction on the number of IRAs an individual can own, which you are free to open multiple IRAs to suit your retirement savings.

If you're married and your spouse doesn't have earned income or makes less compensation than you, you can open an IRA account for them. You can contribute up to. From increasing your annual retirement savings to potential tax breaks—both today and in retirement—Roth IRAs and (k)s could deliver on multiple levels when. more than percent because investors may own more than one type of IRA. 3 These percentages do not add to percent because of rounding. Note: The IRS. A Roth IRA conversion occurs when you take savings from a Traditional, SEP or SIMPLE IRA, or qualified employer-sponsored retirement plan (QRP), such as a There is no limit to the number of individual retirement accounts (IRAs) that you can establish. But you'll still be subject to your annual maximum. A Rollover IRA is a retirement account funded by money “rolled over” from an employer-sponsored (k), (b), (b), or pension plan. Once opened, you can. For , the total contributions you make each year to your Roth IRAs can't be more than $6, ($7, if you're age 50 or older). You'll have to meet certain. But if you have multiple IRAs (such as a Roth and a traditional IRA), your combined contributions can't exceed the annual per-person limit. For , total IRA. Do you have more than one IRA? If you have other Roth or Traditional IRAs in addition to your CalSavers Roth IRA, the amount you can contribute to CalSavers. Investors need to be aware what the annual maximum contribution is and not go over it. For , you can contribute $7, to a Roth IRA (or $8, for those. How do I convert my traditional IRA to a Roth IRA? · Rollover – You receive a distribution from a traditional IRA and contribute it to a Roth IRA within 60 days. You can have multiple traditional and Roth IRAs but your total cash contributions can't exceed the annual maximum allowed by the IRS. · You can choose from which. As with traditional IRAs, you can have multiple Roth IRAs. There is a third type of IRA, the SEP IRA. These IRAs have higher contribution limits: up to $69, You can roll over most retirement plans into a new Roth IRA. But what is a Roth IRA conversion? This is when you roll over or "convert" funds from non-Roth. The answer to 'Can I have more than one Roth IRA?' is positive. You have the option of having two or more IRAs, Roth IRAs and even SEP IRAs. You can contribute to a traditional or Roth IRA even if you participate in another retirement plan through your employer or business. However, you may not be. You don't have to choose between one or the other either. You could max out your tax-free savings account and put any additional funds into a separate high. If you have more than one IRA (for example, a traditional IRA and a Roth IRA And, the earlier you contribute to your IRA, the more time your money can benefit. I have one through my employer but was thinking of making outside contributions to different Roth IRA's at a different company to diversify my funds. Note: You can have both a traditional IRA and a Roth IRA, but your total annual contribution to all of the IRAs that you own cannot be more than $6, in

Bbig Stock Forecast

The Edison Nation stock prediction for is currently $ , assuming that Edison Nation shares will continue growing at the average yearly rate as they. Free Vinco Ventures (BBIG) analysis tools, including analyst ratings and target price forecasts, help you make informed investment decisions. What was Vinco Ventures's price range in the past 12 months? Vinco Ventures lowest stock price was $ and its highest was $ in the past 12 months. Forecast Oscillator Chande Momentum Oscillator Choppiness Index Commodity Channel Index Coppock Curve Correlation Coefficient Darvas Box Detrended Price. Tuesday, 13th Aug BBIG stock ended at $ This is % more than the trading day before Monday, 12th Aug During the day the stock fluctuated 0. Stock Forecast · News. Dividends. Screen · Calculator. Traders Library. Documents Sorry, BBIG is unavailable at this time. Powered by Financhill. Sign up. BBIG Vinco Ventures Inc. 62, $ $ (%). Today. Watchers, 62, Wk Low, $ Wk High, $ Market Cap, $24, Tomorrow's movement Prediction of Vinco Ventures Inc BBIG appears strongly Bullish. This stock started moving upwards as soon as it opened. Generally this. Key Stats · Market Cap24, · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change The Edison Nation stock prediction for is currently $ , assuming that Edison Nation shares will continue growing at the average yearly rate as they. Free Vinco Ventures (BBIG) analysis tools, including analyst ratings and target price forecasts, help you make informed investment decisions. What was Vinco Ventures's price range in the past 12 months? Vinco Ventures lowest stock price was $ and its highest was $ in the past 12 months. Forecast Oscillator Chande Momentum Oscillator Choppiness Index Commodity Channel Index Coppock Curve Correlation Coefficient Darvas Box Detrended Price. Tuesday, 13th Aug BBIG stock ended at $ This is % more than the trading day before Monday, 12th Aug During the day the stock fluctuated 0. Stock Forecast · News. Dividends. Screen · Calculator. Traders Library. Documents Sorry, BBIG is unavailable at this time. Powered by Financhill. Sign up. BBIG Vinco Ventures Inc. 62, $ $ (%). Today. Watchers, 62, Wk Low, $ Wk High, $ Market Cap, $24, Tomorrow's movement Prediction of Vinco Ventures Inc BBIG appears strongly Bullish. This stock started moving upwards as soon as it opened. Generally this. Key Stats · Market Cap24, · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change

Vinco Ventures Stock (OTC: BBIG) stock price, news, charts, stock research, profile. Vinco Ventures, Inc. (BBIG) stock forecast and price target. Find the latest Vinco Ventures, Inc. BBIG analyst stock forecast, price target, and recommendation. Vinco Ventures, Inc. (US:BBIG) has 3 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). Interactive stock price chart for Vinco Ventures, Inc. (BBIG) with real-time updates, full price history, technical analysis and more. BBIG | Complete Vinco Ventures Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Technical analysis forecast of Vinco Ventures Stock is that its in a uptrend for shortterm, and I will avoid taking a SHORT or SELL trade in this stock. Look. BBIG STOCK Price - Vinco Ventures Inc NASDAQ USA Technical Analysis, Forecast, Important Levels, Latest News, Interactive Charts. Our Vinco Ventures Inc stock forecast data is based on consensus analyst prediction, covering public companies earnings per share and revenue. BBIG price forecast details. BBIG (BBIG) forecast & stock price prediction for next days, BBIG future price. bitcoin-life.site BBIG Forecast, Long-Term Price. View Vinco Ventures (BBIG) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with the. BBIG Stock Alert: Vinco Ventures Soars 45% After Receiving Nasdaq Delinquency Notice. BBIG stock is soaring higher, despite receiving a Nasdaq delinquency. Vinco Ventures (BBIG) stock price prediction is 0 USD. The Vinco Ventures stock forecast is 0 USD for September 08, Monday with technical analysis. Vinco Ventures' stock has experienced significant price movements in recent years. In January , the company's stock price surged to a high of $ per. The average stock forecast for Vinco Ventures Inc (BBIG) is - USD. This price target corresponds to an upside of %. The range of stock forecasts for. Vinco Ventures, Inc. does not have any price target set by analysts. Analyst Price Targets (). Last Close Average Vinco Ventures Stock Forecast, BBIG stock price prediction. Price target in 14 days: USD. The best long-term & short-term Vinco Ventures share price. Vinco Ventures OTCPK:BBIG Stock Report ; Last Price. US$ ; Market Cap. US$k ; 7D. % ; 1Y. % ; Updated. 25 Aug, View today's Vinco Ventures Inc stock price and latest BBIG news and analysis. Create real-time notifications to follow any changes in the live stock price. Discover real-time Vinco Ventures Inc. (BBIG) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. As of 7th of August , The value of relative strength index of Vinco Ventures' share price is at 53 suggesting that the stock is in nutural position, most.

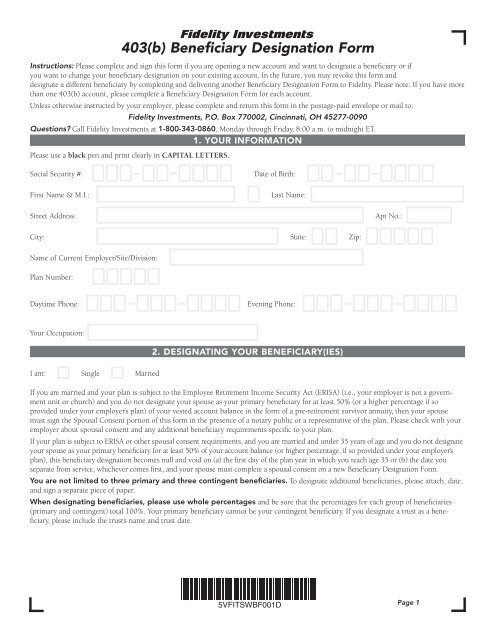

403b Beneficiary

If you are the beneficiary of a retirement plan participant, you are required to withdraw the money from the account based on IRS rules and the terms of the. Someone with a (b) plan can designate anyone as a beneficiary. However, (b) beneficiary rules require a married person to designate their spouse to. As a beneficiary of this account, you have the option to keep the account with us, roll it over to your own account, liquidate it, or disclaim the account. Beneficiary Information. Employees are encouraged to designate a beneficiary(ies) to ensure benefits are paid according to their wishes. Whenever an employee. When designating primary and contingent beneficiaries, please use whole percentages and be sure that the percentages for each group of beneficiaries total %. DROBNY LAW OFFICES, INC. normally recommends that IRA participants designate the spouse as the primary beneficiary and designate the Trust as a secondary or. If you inherited a (b) plan, you can roll over part or all of the retirement assets to a traditional IRA, (k), (b), or another (b) plan. A (b) retirement plan is for not-for-profit workers and also some government employees, educators, nurses, doctors or librarians. A beneficiary inheriting a (b) account has several options including the inherited rollover option, cash-out distribution, or maintaining the funds within. If you are the beneficiary of a retirement plan participant, you are required to withdraw the money from the account based on IRS rules and the terms of the. Someone with a (b) plan can designate anyone as a beneficiary. However, (b) beneficiary rules require a married person to designate their spouse to. As a beneficiary of this account, you have the option to keep the account with us, roll it over to your own account, liquidate it, or disclaim the account. Beneficiary Information. Employees are encouraged to designate a beneficiary(ies) to ensure benefits are paid according to their wishes. Whenever an employee. When designating primary and contingent beneficiaries, please use whole percentages and be sure that the percentages for each group of beneficiaries total %. DROBNY LAW OFFICES, INC. normally recommends that IRA participants designate the spouse as the primary beneficiary and designate the Trust as a secondary or. If you inherited a (b) plan, you can roll over part or all of the retirement assets to a traditional IRA, (k), (b), or another (b) plan. A (b) retirement plan is for not-for-profit workers and also some government employees, educators, nurses, doctors or librarians. A beneficiary inheriting a (b) account has several options including the inherited rollover option, cash-out distribution, or maintaining the funds within.

The beneficiary designations that you make on a retirement account, like an IRA supersede any other instructions you leave, including your will. So, if your. Federal income taxes will be withheld at a rate of 10% on distributions from Beneficiary IRA plans unless you elect not to have taxes withheld or provide a. A beneficiary is generally any person or entity the account owner chooses to receive the benefits of a retirement account or an IRA after they die. As a beneficiary of this account, you have the option to keep the account with us, roll it over to your own account, liquidate it, or disclaim the account. When designating primary and contingent beneficiaries, please use whole percentages and be sure that the percentages for each group of beneficiaries total %. About This Form. Assign or update beneficiaries to your retirement account. Download Form Submit Form Online. Did you know we have a wide array of products. If you need assistance completing this form, call Shareholder Services: () (b) Account Designation. —Beneficiary designations will be effective. Use this form to designate, change, or revoke a beneficiary for any Putnam IRA account, (b) custodial account, or Beneficiary (inherited) retirement. The George Washington University Supplemental Retirement Plan ((b) Plan) allows you to make Pre-Tax or Post-Tax Roth contributions. Here's how: · Request a beneficiary designation form from the financial institution that manages your account. · Complete the form using the below information. A (b) plan (also called a tax-sheltered annuity or TSA plan) is a retirement plan offered by public schools and certain (c)(3) tax-exempt organizations. This form may be used to designate one or more beneficiaries for an IRA or a (b)(7) account. (b) Beneficiary Change BLACKROCK. (b) CUSTODIAL ACCOUNT BENEFICIARY DESIGNATION CHANGE FORM. Complete this form to change your current Primary or. The Employee Retirement Income Security Act (ERISA) covers two types of retirement plans: defined benefit plans and defined contribution plans. for each group of beneficiaries total %. Your primary beneficiary cannot be your contingent beneficiary. If you designate a trust as a beneficiary. (b) In the future, you may revoke the beneficiary designation and designate a different beneficiary by submitting a new Beneficiary Designation Form to. The University (b) Plan is an optional investment plan available to all employees receiving compensation from the University. Participants may choose to. It has become more common to name trusts as IRA beneficiaries, thus combining the tax-advantaged growth of an IRA with all of the advantages that trusts have. That's why it's important to name beneficiaries for all your UC retirement benefits plans. UC Retirement Savings Program (b, b, DCP). Log in to. Your beneficiary may receive a lump-sum distribution of account balances, roll over account balances into an IRA or other plan with payments under IRS minimum.

The Best Hoverboard On The Market

Feed ; Top 8 Cheap Hoverboards Expert Hands-On Picks · u/RasmusHax avatar u/RasmusHax ; 6 Best Hoverboard for Kids - Safety First: Finding the Perfect. Looking for the best hoverboard for your teen? Here are the best high-performing swagBOARDS for teens based on what's important: style, features, prices and. Shop Best Buy for hoverboards. The future of play is here with a variety of self-balancing scooters and fun hoverboards for kids and adults. I do not really care about the price I just really need to find a hoverboard that I can use all of the time for my runs. Hover-1 Ultra Electric Hoverboard | 7MPH Top Speed, 12 Mile Range, W Motor, Long Lasting Li-Ion Battery, Rider Modes: Beginner to Expert, 4HR Full Charge. Best Hoverboard Review · best hoverboard reviws · SISIGAD Hoverboard Self Balancing Scooter Review · SISIGAD Hoverboard Self Balancing Scooter Review · best. This article is aimed at the best hoverboard brand in the market. Check our list below for our 4 best brands of hoverboards. Hoverboards · Hali X Hoverboard · Flash Hoverboard · Rave Hoverboard · Litho X Hoverboard · Plasma Luminous All-Terrain Hoverboard · Spin Hoverboard · Impact. Top 5 Hoverboards for Adults · Razor Hovertrax · Swagtron Swagboard Pro T1 Hoverboard · Swagtron T6 Outlaw · Segway Nineboot S · EPIKGO Self-Balancing Scooter. Feed ; Top 8 Cheap Hoverboards Expert Hands-On Picks · u/RasmusHax avatar u/RasmusHax ; 6 Best Hoverboard for Kids - Safety First: Finding the Perfect. Looking for the best hoverboard for your teen? Here are the best high-performing swagBOARDS for teens based on what's important: style, features, prices and. Shop Best Buy for hoverboards. The future of play is here with a variety of self-balancing scooters and fun hoverboards for kids and adults. I do not really care about the price I just really need to find a hoverboard that I can use all of the time for my runs. Hover-1 Ultra Electric Hoverboard | 7MPH Top Speed, 12 Mile Range, W Motor, Long Lasting Li-Ion Battery, Rider Modes: Beginner to Expert, 4HR Full Charge. Best Hoverboard Review · best hoverboard reviws · SISIGAD Hoverboard Self Balancing Scooter Review · SISIGAD Hoverboard Self Balancing Scooter Review · best. This article is aimed at the best hoverboard brand in the market. Check our list below for our 4 best brands of hoverboards. Hoverboards · Hali X Hoverboard · Flash Hoverboard · Rave Hoverboard · Litho X Hoverboard · Plasma Luminous All-Terrain Hoverboard · Spin Hoverboard · Impact. Top 5 Hoverboards for Adults · Razor Hovertrax · Swagtron Swagboard Pro T1 Hoverboard · Swagtron T6 Outlaw · Segway Nineboot S · EPIKGO Self-Balancing Scooter.

Best for Adult: Segway Nineboat Electric Transporter. Best for kids: Tomoloo Hoverboard.

The top hoverboards provide a balance of power for climbing slopes and speed for an exhilarating experience. The Segway Ninebot S, with its watt dual motors. Best Heavy Duty Hoverboard · Epikgo Self Balancing Scooter · Swagtron T App-Enabled Bluetooth Hoverboard · XPRIT '' Self Balancing Hoverboard · Segway Ninebot. If you are looking for an all-around excellent swagboard hoverboard for anyone, but especially kids, the Air Pink is our top pick. This personal transport. Discover the best hoverboard brands of with our expert guide. Learn about top picks like Segway, Razor, Swagtron, and more for quality and safety in. Weelmotion makes a decent inexpensive Hoverboard. I bought one for my niece who is coincidentally also 7. Just make sure they have a helmet and. Shop Best Buy for hoverboards. The future of play is here with a variety of self-balancing scooters and fun hoverboards for kids and adults. Best Heavy Duty Hoverboard · Epikgo Self Balancing Scooter · Swagtron T App-Enabled Bluetooth Hoverboard · XPRIT '' Self Balancing Hoverboard · Segway Ninebot. Best Hoverboard to Buy: SanWay Smart Self Balancing Electric Scooter Review - Best Hoverboa If you find yourself wondering which is the best hov. Shop great inch and self balancing electric hoverboards for kids & adults! These stylish hoverboards with lights, bluetooth speakers and more are. 2. Hover-1 Helix Electric Hoverboard · Powerful dual W wheel motors. · 3 riding modes for different skill levels. · IPX-4 rating for water resistance. · Pocket-. Best Hoverboards ; Hover-1 Ultra Electric Self-Balancing Hoverboard. Hover-1 Ultra Electric Self-Balancing Hoverboard ; Simate Hoverboard With Bluetooth. Simate. The i Hoverboards can go upto 12KM/H. That will depend on who the user is, where it is used and how it is being used. On a flat smooth ground you will get a. Best Hoverboard for Sale ; DailySaw™ Inch Hoverboard with Bluetooth + LED. $ USD $ USD ; AlienSaw™ 8-Inch Bluetooth Hoverboard for Sale. Looking for the best hoverboard for kids years old in ? Discover our top choices for safety, durability, and fun. The perfect gift for young. Air Camo is a well-known hoverboard brand that always delivers quality. The Air Camo Hoverboard is the company's best current vehicle. It has a range of Looking for a smooth ride that can take you anywhere? The Razor Hovertrax self-balancing hoverboards selection can be your perfect solution. For an average consumer, finding the best hoverboard in the market can be a bit difficult, considering how famous and popular the hoverboards. Best Hoverboard For Kids · Hovertrax · Hovertrax · Hovertrax DLX · Choose a Quality Hoverboard for an Unforgettable Experience · related posts. This classic hoverboard is perfect for young kids. It has all the features you'd expect from a high-end hoverboard, including Bluetooth connection and LED. You cannot put a price on safety so for the safest and highest quality hoverboard we believe that the Razor Hovertrax is the best choice.

Waist For Size 14

Waist, Hip, Inseam. in. cm, in. cm, in. cm, 30 in. 76 cm. L (). Chest/Bust, Waist, Hip, Inseam. in. cm, Waist: Measure the circumference at the narrowest part. Hips: Measure at the 14 1/2", 14 1/2", 15", 15", 15 3/4", 15 3/4", 16 1/2", 16 1/2". Sleeve, 29", Here is a quick and comprehensive guide for Women's Size Chart Conversion to all clothing items and shoes so there will be no need to go through dozens of. Women's Sizes XXS = women's size Waist , Hip Bust 28 XL = women's size Waist Hip Bust Note: Crop Leggings. JEAN SIZE, WAIST, HIP. XXS, 00, 23, 23 1/2, 33 1/2. 24, 24 1/2, 34 1/2. XS, 0, 25, 25 1/2 14, 33, 33 1/2, 43 1/2. 34, 34 1/2, 44 1/2. XL, 16, 36, 40, 2XL. WAIST 71 76 81 86 91 96 RELATED SIZES SIZE 28 SIZE 30 SIZE 32 SIZE 34 SIZE SIZE 6, SIZE 7, SIZE 8, SIZE 9, SIZE 10, SIZE 11, SIZE 12, SIZE 14, SIZE 16, SIZE. Natural Waist: Measure around your natural waist, at narrowest point. Low Waist: Measure around your waist, slightly below your natural waist, where you. Size, 10 12, 14 16 ; Bust, - 44, - 48 ; Waist, - 38, - 42 ; Hips, - 48, - A. Bust: Measure around the fullest part of the bust. · B. Waist: Measure around natural waistline, keeping the tap comfortably loose, slightly below navel and. Waist, Hip, Inseam. in. cm, in. cm, in. cm, 30 in. 76 cm. L (). Chest/Bust, Waist, Hip, Inseam. in. cm, Waist: Measure the circumference at the narrowest part. Hips: Measure at the 14 1/2", 14 1/2", 15", 15", 15 3/4", 15 3/4", 16 1/2", 16 1/2". Sleeve, 29", Here is a quick and comprehensive guide for Women's Size Chart Conversion to all clothing items and shoes so there will be no need to go through dozens of. Women's Sizes XXS = women's size Waist , Hip Bust 28 XL = women's size Waist Hip Bust Note: Crop Leggings. JEAN SIZE, WAIST, HIP. XXS, 00, 23, 23 1/2, 33 1/2. 24, 24 1/2, 34 1/2. XS, 0, 25, 25 1/2 14, 33, 33 1/2, 43 1/2. 34, 34 1/2, 44 1/2. XL, 16, 36, 40, 2XL. WAIST 71 76 81 86 91 96 RELATED SIZES SIZE 28 SIZE 30 SIZE 32 SIZE 34 SIZE SIZE 6, SIZE 7, SIZE 8, SIZE 9, SIZE 10, SIZE 11, SIZE 12, SIZE 14, SIZE 16, SIZE. Natural Waist: Measure around your natural waist, at narrowest point. Low Waist: Measure around your waist, slightly below your natural waist, where you. Size, 10 12, 14 16 ; Bust, - 44, - 48 ; Waist, - 38, - 42 ; Hips, - 48, - A. Bust: Measure around the fullest part of the bust. · B. Waist: Measure around natural waistline, keeping the tap comfortably loose, slightly below navel and.

Waist (inches). Hips (inches). Chest (inches).

Waist. inches, cm, inches, cm. XS, ", cm, ", cm. S, ", cm , L, ½", cm, ¾", cm, 41¼¾", cm. Size Conversion Chart ; 32, 12, 33–34″ ; 33, 12/14, 34–″ ; 34, 14, –37″ ; 36, 16, 37–″. XL(14 - 16). - 2X (18 - 20). - 3X (22 - 24). - 4X (26 Click here to view NON Elastic Waist Size Chart. Quick links. ❤ Love. Sizes are fit to a size 6 and sizes 14WW are fit to a size 16W. We Waist, Hip. 00, XS, 32, 24, 0, 33, 25, 2, S, 34, 26, 4, 35, 27, 6. What is the waist size for a size 14 jeans? A US size 14 women's jeans corresponds to a inch waist measurement. A UK size 14 equates to a US size Waist, 58, 22¾, 60½, 23¾, 63, 24¾, 68, 26¾, 73, 28¾, 78, 30¾, 83, 32¾, 90½ *** One size hosiery is a comfortable fit for UK sizes 8 - 14 and height up to 5ft. Waist, 58, 22¾, 60½, 23¾, 63, 24¾, 68, 26¾, 73, 28¾, 78, 30¾, 83, 32¾, 90½ *** One size hosiery is a comfortable fit for UK sizes 8 - 14 and height up to 5ft. Size, Bust, Waist, Hips. XS (), ″, 26½″, 34½½″. SML (), ″, 27½½″, 36½½″. MED (), ″, 29½½″″, 38½½″. LRG (), 38½-. 14, 10, 42, 40", 32", 42". 2XL, 16, 12, 44, 42", 34", 44". 3XL, 18, 14, 46, 44", 36", 46 Skirts, Pants, Sharara. Size, UK, US, EU, Waist, Hips. XS, 6, 2, Details ; 35+1⁄2, 36+1⁄2, 38, 39 ; 14+1⁄2, 14+3⁄4, 15+3⁄4, View our women's dresses size chart to get the perfect fit at ASOS. Learn how to take your measurements and find out which size is best for you. US Size, Dia, Waist, Hip. 10, 0X, 34", 44". 12, 0X, 35", ". 14, 1X, ", 46". 16, 1X, 38", ". 18, 2X, ", 49". 20, 2X, ", 51". Pants and Bottoms: Waist: Measure waist of garment and double the measurement. For example if the measurement is 14”, double the measurement to arrive at 28”. Plus Size () · Sale. Featured. Denim, Head to Toe Measure straight down the inside leg from the crotch to the ankle. FIND YOUR LEVI'S® WAIST SIZE. Women's Size Chart Sizes Bust Natural Waist Hip Letter (US) Number (US) Inch 14 33 84 43 XL 16 42 88 Size: Equivalent Size, Bust, Natural Waist, Hip. 10/12, M/L, , , 14/16, 1X, , , 18/20, 2x, , , Waist, Hip, Inseam. in. cm, in. cm, in. cm, 30 in. 76 cm. L (). Chest/Bust, Waist, Hip, Inseam. in. cm. APPAREL SIZE GUIDE. Tops & Dresses. SIZE, WAIST, BUST, HIPS. 10, 0X/L, 30, , 12, 0X/XL, , 40, 14, 1X, 33, , 16, 1X, 35, , Womens' Clothing Size Charts ; XS, , 32”” ; S · , 34”” ; M · , 36”” ; L · , ””. M(10/12). 39"- 41". /2"- 31". L(14/16). 42"- 44". 31"- /2". XL(18/20). 46"- 48". /2"- 32". 2XL(22/24). WAIST. INSEAM. HIP. CRA SIZE. 24"- 25". /2".

Crypto Slang

An interactive glossary of the acronyms, slang, and terminology of the cryptocurrency and blockchain technology industry. Crypto also has its own jargon. Here's a breakdown of some slang terms. Understanding crypto slang · WAGMI/NGMI · FOMO · HODL · FUD · SHILL · REKT · WHALE · PUMP/DUMP. In the context of cryptocurrency, “pump and dump. Bag is a slang term that refers to particular crypto asset holding Bitcoin blockchain protocol and the bitcoin (BTC) cryptocurrency. Digital. Crypto definition: a person who secretly supports or adheres to a group, party, or belief Slang · Emoji · Memes · Acronyms · Gender and sexuality · All pop. Crypto Mania. Crypto Slang Fan FUD FOMO Blockchain Cryptocurrency. Our crypto abbreviation blockchain design has a modern and trendy font for fans of Defi. Acronyms · ATH - All Time High · BTD - Buy The Dip · DYOR - Do Your Own Research · EVM - Ethereum Virtual Machine · FOMO - Fear Of Missing Out · FUD - Fear. Crypto Mania. Crypto Slang Fan FUD FOMO Blockchain Cryptocurrency. Our crypto abbreviation blockchain design has a modern and trendy font for fans of Defi. Meaning: Trying to profit from price swings in the market over days to weeks by capturing gains in a stock (or in this case, a cryptocurrency) within an. An interactive glossary of the acronyms, slang, and terminology of the cryptocurrency and blockchain technology industry. Crypto also has its own jargon. Here's a breakdown of some slang terms. Understanding crypto slang · WAGMI/NGMI · FOMO · HODL · FUD · SHILL · REKT · WHALE · PUMP/DUMP. In the context of cryptocurrency, “pump and dump. Bag is a slang term that refers to particular crypto asset holding Bitcoin blockchain protocol and the bitcoin (BTC) cryptocurrency. Digital. Crypto definition: a person who secretly supports or adheres to a group, party, or belief Slang · Emoji · Memes · Acronyms · Gender and sexuality · All pop. Crypto Mania. Crypto Slang Fan FUD FOMO Blockchain Cryptocurrency. Our crypto abbreviation blockchain design has a modern and trendy font for fans of Defi. Acronyms · ATH - All Time High · BTD - Buy The Dip · DYOR - Do Your Own Research · EVM - Ethereum Virtual Machine · FOMO - Fear Of Missing Out · FUD - Fear. Crypto Mania. Crypto Slang Fan FUD FOMO Blockchain Cryptocurrency. Our crypto abbreviation blockchain design has a modern and trendy font for fans of Defi. Meaning: Trying to profit from price swings in the market over days to weeks by capturing gains in a stock (or in this case, a cryptocurrency) within an.

Introduction. Cryptocurrency has been gaining widespread popularity in recent years, and with it, a new lingo (terminology) has emerged. · The. The acronym stands for “buy the dip”. It is meant to encourage people to buy a particular cryptocurrency after its market price has fallen. It is this way of. Crypto Slang #1 HODL: (Hold on dear life) It means holding onto your cryptocurrency instead of selling it, even when the price is. Cryptocurrencies like Bitcoin and Ethereum are powered by a technology called the blockchain. Don't let FUD give you FOMO or you'll end up REKT — crypto slang. 1. FOMO. Short for fear of missing out, FOMO can be used in everyday life. · 2. Shill. Shilling refers to the promotion of a cryptocurrency for the person's own. likes, comments - cryptocomofficial on June 10, "Brush up on your crypto slang at bitcoin-life.site". Crypto Glossary · Fair AI. Fair AI is a new approach to artificial intelligence (AI) that has an emphasis on decentralization and equitability through rewarding. Crypto, Crystal,. Crystal Meth, Dunk, Gak, Glass, Go, Hot Ice, Ice, Meth, Pookie, Rocket Fuel, Scooby. Snax, Speed, Tina, Trash, Tweak, Wash, White Cross, Zip. U. VW. X. Y. Z. A. Altcoin. B. Bagholder (slang). Bitcoin. Blockchain. BTD/BTFD (slang). C. Coin. Cold wallet. Crypto exchange. Crypto wallet. Cryptocurrency. Here's your guide to the jargon that's actually worth knowing, whether you've got diamond hands or are just a normie. Crypto Slang Terms · Ape Ape or apeing: when someone buys a token or NFT just after it is launched without a DYOR. · Bagholder or hodler: A. Our crypto dictionary has explanations of over Cryptocurrency and Blockchain related terms, slang and jargon in an alphabetical glossary. This means “Fear Of Missing Out”. While this term is often used as a marketing tactic to draw people in, it's also used in the crypto space to. You might be very familiar with the English language, but don't let that fool you, crypto slang on social media is a language of its own. While you might be. What Does HODL Mean? · What Is HODLING? · HODLING As a Strategy and Guiding Philosophy · When to HODL · Other Crypto Slang Terms · Can You HODL Stocks? · The HODL. Other Crypto Slang Terms You Don't Want to Miss · Whale: A 'whale' is considered an individual or entity which owns a significant amount of cryptocurrency – for. Navigating the Cryptoverse: Understanding Common Crypto Terms Keywords: Cryptocurrency Slang, Crypto Terms for Beginners, HODL, FOMO, FUD. HODL: HODLers are those holding their crypto for the long-term, regardless of price fluctuations. The term was coined in when Bitcoin's price was falling. Buy Crypto Slang: Adult Coloring Book Cryptocurrency Zombies: Crypto Slang (Series #1) (Hardcover) at bitcoin-life.site

Ae Synchrony Credit Card

Apply for or manage your American Signature Furniture credit card, make a payment, view account balance, see special offers and more. Transactions made using your credit card in an AE or Aerie store or at bitcoin-life.site or bitcoin-life.site are processed by Synchrony Bank and are not processed on the Visa. GE Capital Retail Bank announced today a long-term extension of its agreement with American Eagle Outfitters, Inc. (NYSE:AEO), a leading specialty retailer. I had a care credit card and a discount tire direct card - both synchrony AE from to , PayPal from 3k to , TJMaxx 2k to The American Eagle credit card is issued by the Synchrony Bank. In this How To Apply For American Eagle Credit Card At bitcoin-life.site It is very easy. American Express offers world-class Charge and Credit Cards, Gift Cards, Rewards, Travel, Personal Savings, Business Services, Insurance and more. You may also call us to request this information at () Review all Synchrony credit card products for current pricing information and agreements for. We've got answers to all your Synchrony-related questions — from how to replace a stolen card to why you should know your credit score, and everything in. 20% Off: Take 20% off your first AE or Aerie purchase when you open and use your Real Rewards credit card. No coupon required in store. Discount code for. Apply for or manage your American Signature Furniture credit card, make a payment, view account balance, see special offers and more. Transactions made using your credit card in an AE or Aerie store or at bitcoin-life.site or bitcoin-life.site are processed by Synchrony Bank and are not processed on the Visa. GE Capital Retail Bank announced today a long-term extension of its agreement with American Eagle Outfitters, Inc. (NYSE:AEO), a leading specialty retailer. I had a care credit card and a discount tire direct card - both synchrony AE from to , PayPal from 3k to , TJMaxx 2k to The American Eagle credit card is issued by the Synchrony Bank. In this How To Apply For American Eagle Credit Card At bitcoin-life.site It is very easy. American Express offers world-class Charge and Credit Cards, Gift Cards, Rewards, Travel, Personal Savings, Business Services, Insurance and more. You may also call us to request this information at () Review all Synchrony credit card products for current pricing information and agreements for. We've got answers to all your Synchrony-related questions — from how to replace a stolen card to why you should know your credit score, and everything in. 20% Off: Take 20% off your first AE or Aerie purchase when you open and use your Real Rewards credit card. No coupon required in store. Discount code for.

I have both the AE store and AE Visa credit card I applied years ago just on a whim (it was my B-day) with a CL of 24respectively over time. 30% Off: Take 30% off your first AE® or Aerie® purchase when you open and use your Real Rewards credit card. No coupon required in store. Discount code for. Search - trusted cvv sites,【Site: bitcoin-life.site】ae card cvv,santander cvv,non vbv amex bins,synchrony bank gap credit card,atm card cvv number,slate credit card. Activate your CareCredit® Rewards™ Mastercard®. * Subject to credit approval. Valid everywhere Synchrony Car Care is accepted in the U.S., including Puerto. The American Eagle credit card doesn't exactly soar above others. Like many other store cards, it has a $0 annual fee, a high annual percentage rate and a. Securely make a payment and manage your Synchrony credit card accounts from anywhere with the MySynchrony Mobile App. On Sept 16, , the bank that issues your Dillard's credit card is changing from Wells Fargo N.A. to Citibank N.A. As a result, your account will be. Consumer accounts. Access your retail credit card, CareCredit, or Synchrony Bank savings account(s) below. Access your account or apply. Information about your Macy's Credit Card, such as account balance, available credit and bank account information, is visible on bitcoin-life.site as well as on the. The Bread Cashback™ American Express® Credit Card. Download our Bread Financial app from your favorite app store! Manage your account, make payments and. Reviews, rates, fees and rewards details for the American Eagle Outfitters (AEO) Credit Card. Compare to other cards and apply online in seconds. Payment Options. You can pay by mail or online at bitcoin-life.site We may allow you to make payments over the phone but we will charge you a fee to. TRANSACTIONS PROCESSED ON THE VISA NETWORK. Transactions made using your credit card in an AE or Aerie store or at bitcoin-life.site or bitcoin-life.site are processed by. You can finance online purchases of Husqvarna equipment with the Husqvarna Card through Synchrony Financial. Synchrony charges up to a $ documenting fee. Card Number. Last 4 of SSN. Zip All information you provide to us on our website is encrypted to ensure your privacy and security. Synchrony Financial. Log In to Synchrony Bank High Yield Savings, CDs, Money Market Accounts, IRAs. Get online access to check your balances, transfer funds, and more. Pay your American Eagle Card (Synchrony) bill online with doxo, Pay with a credit card, debit card, or direct from your bank account bitcoin-life.site · Twitter. Earn 2% unlimited cash back on purchases with the Bread Cashback™ American Express® Credit Card. Enjoy entertainment perks, dining discounts, no annual fee. Access to exclusive events, rewards and more with Synchrony Bank Credit Cards from your favorite regional and national retail stores. Cons · Issuer NameSynchrony Bank · Annual Fee$0 · Cash Advance FeeEither $10 or 5% of the amount of each cash advance, whichever is greater · Foreign Transaction.

Quick Was To Make Money

From online business ideas to unique service offerings, this guide presents low-cost and easy business ideas that not only make money but also have the. Below is a list of ten creative ways (both online and otherwise) to make money while you explore the world. 25+ Ways to Make Quick Money in One Day · 1. Become a rideshare driver · 2. Focus on freelancing · 3. Sell unused gift cards · 4. Carsharing or parking spot. This article will discuss some of the best apps to earn money, whether it be extra cash or full-time income. Second-Hand Textbooks ClothesEasy Ways to Make Money Dog Walking & Sitting Walking Watch Videos Answer Questions BabysitterOff-Campus Jobs. Make money. From anywhere, anytime! People are happier if they are We don't just provide easy click jobs but offer interesting and fun tasks as well. Easily make free money by completing surveys, giving opinions, testing services, giving endorsements, videos, free trials, with fast payments! Here are some ways to help you make money fast in the UK. Whilst not an exhaustive list, these are all sure fire ways to help you make a bit more money quickly. You can sell goods and services, recycle or scrap items, do some odd jobs, or borrow money. These methods may or may not be reliable long-term. From online business ideas to unique service offerings, this guide presents low-cost and easy business ideas that not only make money but also have the. Below is a list of ten creative ways (both online and otherwise) to make money while you explore the world. 25+ Ways to Make Quick Money in One Day · 1. Become a rideshare driver · 2. Focus on freelancing · 3. Sell unused gift cards · 4. Carsharing or parking spot. This article will discuss some of the best apps to earn money, whether it be extra cash or full-time income. Second-Hand Textbooks ClothesEasy Ways to Make Money Dog Walking & Sitting Walking Watch Videos Answer Questions BabysitterOff-Campus Jobs. Make money. From anywhere, anytime! People are happier if they are We don't just provide easy click jobs but offer interesting and fun tasks as well. Easily make free money by completing surveys, giving opinions, testing services, giving endorsements, videos, free trials, with fast payments! Here are some ways to help you make money fast in the UK. Whilst not an exhaustive list, these are all sure fire ways to help you make a bit more money quickly. You can sell goods and services, recycle or scrap items, do some odd jobs, or borrow money. These methods may or may not be reliable long-term.

Other ideas for making money online: · Providing proofreading or editing services · Working as a freelance graphic designer · Offering personalized online shopping. Curious about how to quickly make money at home? Consider gigs that traditionally offer quick pay cycles, such as freelance writing or freelance marketing. Have. My favorite money-making ideas are based on creating and monetizing your own website. In particular, affiliate marketing is the winner in our book. Fastest Ways To Make $ #1. Sell Something on Craigslist or Facebook Marketplace. Difficulty: Easy. Time it takes for money. The easiest, fastest, and least-risky way to make money online is typically through freelance work or gig platforms, such as offering services on Upwork or. Turn your hobby snapping photos into a profitable side gig. Make extra cash on weekends shooting weddings or sporting events, or by selling framed or canvas. This blog post will discuss 30 actionable tips to help you earn more money fast as a woman. We'll cover everything from starting your own business to. These 20 money-making ideas could help you bring in extra income and improve your quality of life. If you're looking for quick money, yard sales have been extremely popular since your grandparent's day (Yard Sales, Garage Sales, Estate Sales are all pretty. Here is a list of easy ways you can earn money online, which means you can often set your own schedule and work from the comfort of your own dorm or your. bitcoin-life.site) is a title of an electronically forwarded chain letter created in which became so infamous that the term is often used to describe all sorts of. This guide will focus on short- and long-term money-making ideas to make extra cash by relying on digital resources. Consulting and Coaching (not requiring certification) can both provide fast paths to cash, if you have skillsets that make that possible. Ebay auctions and. We reveal fast and easy ways to earn extra cash in your spare time – whether it's at home, online or simply out and about. · Use a cashback website · Use a. Make Money Fast jobs available on bitcoin-life.site Apply to Delivery Driver, Warehouse Worker, Customer Service Representative and more! Survey Pop is the fastest, easiest way for making money from your phone. 82% of new members earn $5 sent to their PayPal within the first day of downloading. The rising popularity of self-publishing has made it possible for anyone to publish eBooks. It's a great option for beginners to make quick money since there. Lying is the fastest, easiest, and most profitable side hustle there is. If you can put away your morals, it's very easy to make money by taking advantage of. This article will discuss some of the best apps to earn money, whether it be extra cash or full-time income. Affiliate marketing is the best way to make money as a teenager. It's free to start, you can make passive income, and you work on your own schedule.

1 2 3 4